Global markets presented a complex and mixed outlook on Tuesday, as investors held their collective breath ahead of pivotal debt-ceiling talks in the United States. Concurrently, Japan’s Topix reached a milestone, closing at its highest since 1990, while European shares presented a more sobering picture, with Vodafone Group Plc and Telecom Italia SpA suffering losses due to weak earnings and withdrawn investment.

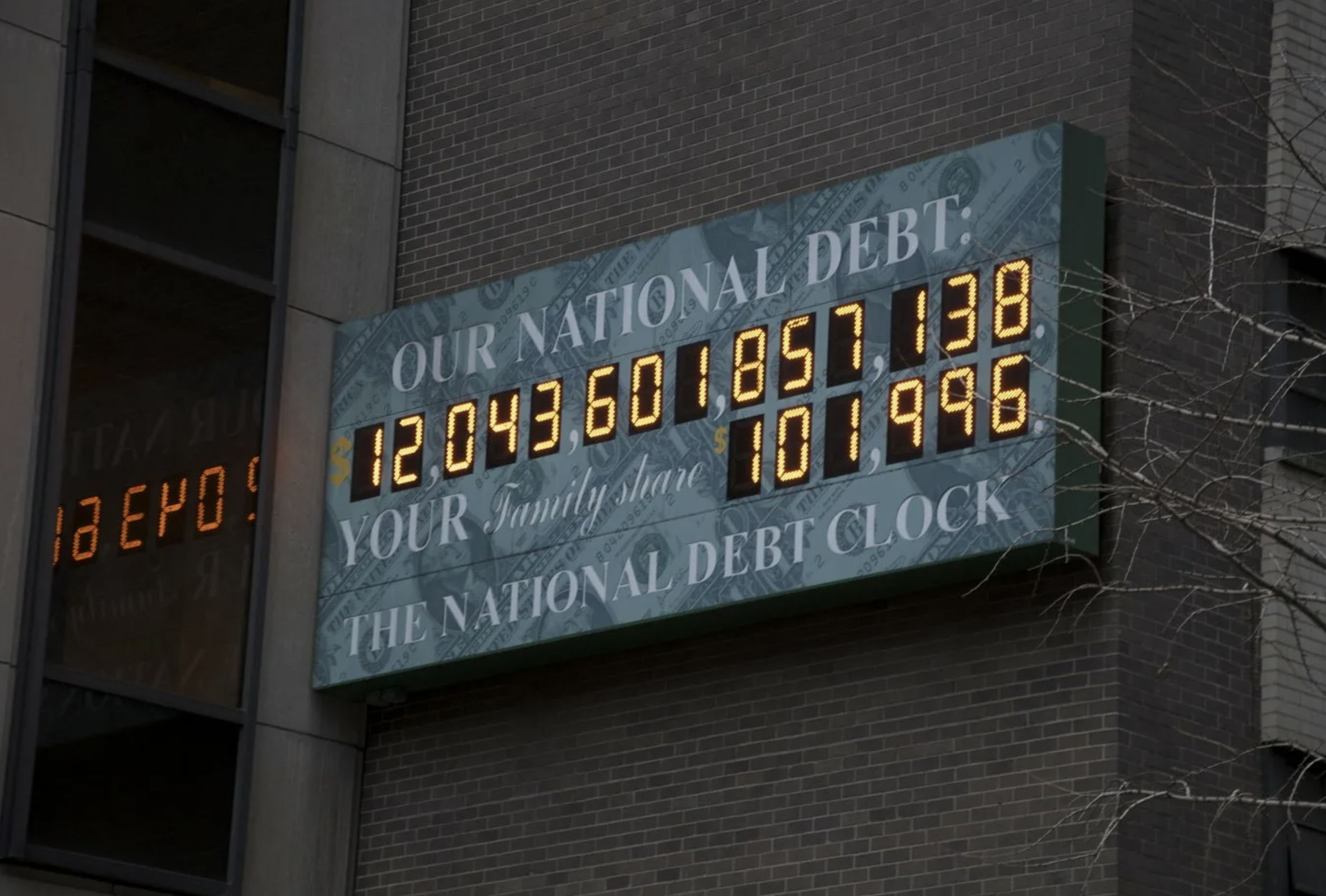

The impasse over the U.S. federal debt limit continued to dominate investor sentiment, as many remain on the sidelines, waiting for a breakthrough in the stalemate playing out in Washington. The situation has sparked fears of an economic slowdown and a possible default, even as Treasury Secretary Janet Yellen warned of the existing costs of failing to raise the debt limit. She reiterated her previous warning that the U.S. Treasury might run out of cash as soon as June 1.

“We are all looking to Congress and the White House to see how the U.S. debt ceiling discussions are moving ahead,” said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “Now that we have sufficient clarity on central bank policy and are close to the rate hike cycle peak, investors are looking for clarity on the political front before the coming earnings season.”

Despite the palpable tension and uncertainty, most investors maintain the expectation that politicians will strike a last-minute deal to prevent a default. This optimism is reflected in the yield on policy-sensitive two-year Treasuries, which fell three basis points, trading just below 4%.

However, this guarded optimism cannot mask a series of concerning indicators. The U.S. economy is showing signs of deceleration while inflation continues to run hot. A string of regional bank failures has stirred fears of a potential credit crunch. In Bank of America Corp.’s latest survey, 65% of participants predicted a weakening economy and reported larger allocations to havens such as cash and big tech.

On the other side of the Pacific, Japan’s Topix equities benchmark defied the global trend, climbing to its highest level since 1990. The resurgence is largely credited to a renewed push by Japan’s corporations to increase buybacks and focus on returns. “We believe Japanese stocks still have further to go,” Fabiana Fedeli, chief investment officer for equities and multi assets at M&G Plc, commented.

China, however, painted a more dismal picture, with stocks falling in Shanghai and Shenzhen after official data showed that industrial output, retail sales, and fixed investment all missed estimates in April. This disappointing performance indicates the need for more policy support in the future.

Meanwhile, the dollar pulled back against most of its Group of 10 peers, while crude prices made a modest gain after the International Energy Agency predicted a stronger than anticipated demand for oil this year.

With the Eurozone GDP announcement, US retail sales data, and speeches from several Fed speakers on the horizon this week, the global market continues to fluctuate in the face of uncertainty. As investors, analysts, and policymakers navigate this challenging landscape, the world watches with bated breath for the next developments.