Vietnam’s richest man, Pham Nhat Vuong, is betting $8 billion on electric vehicles (EVs) through his automaker, VinFast. Despite setbacks faced by other billionaires who took on the challenge of developing EVs, Vuong is determined to make it work. He has already invested $8.2 billion in VinFast’s operating expenses and capital expenditures over the past six years. However, the return on investment has been lackluster, with VinFast selling only 93,000 vehicles and 162,000 e-scooters.

Vuong is determined to make VinFast a success in the US market and has personally committed $1 billion of the $2.5 billion the company has secured. Despite delays to its US IPO, VinFast plans to start delivering longer-range versions of its VF 8 SUVs to US customers this month.

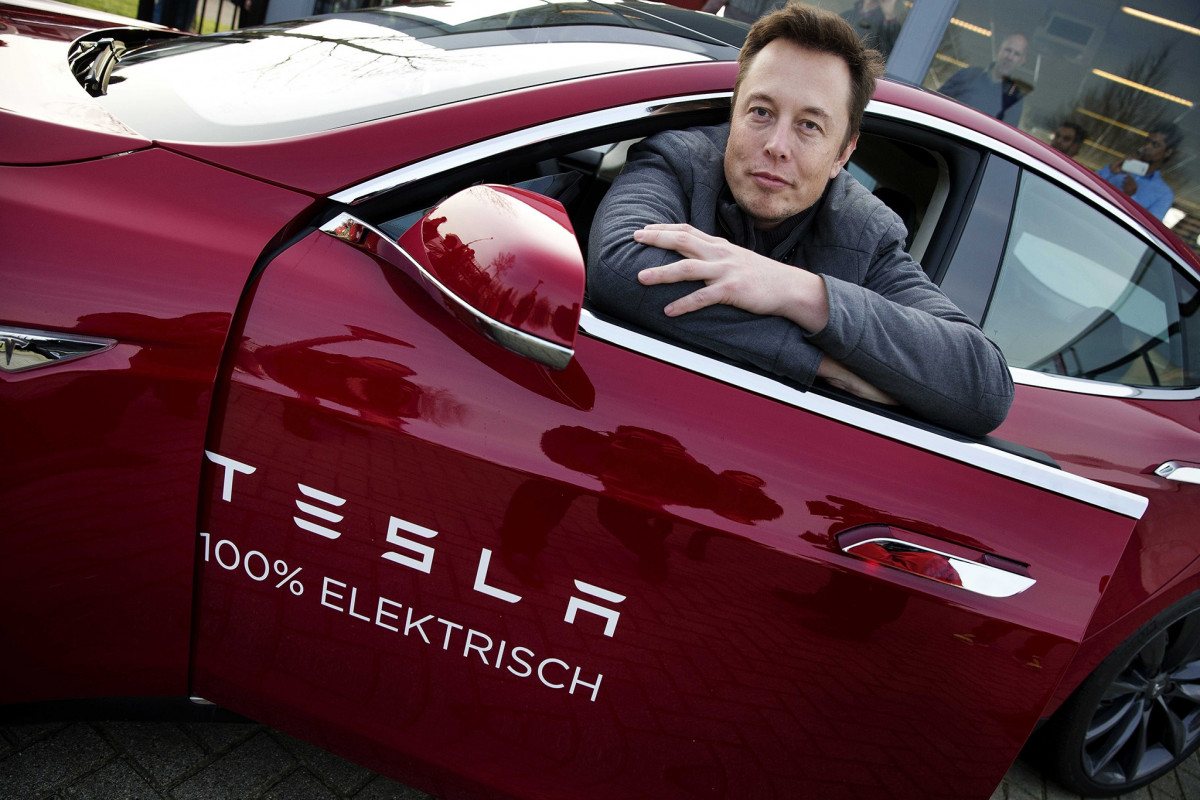

However, VinFast is entering a fiercely competitive electric vehicle market, with Tesla cutting prices and challenging long-established players. VinFast will need to spend heavily on building brand recognition and establishing distribution and retail networks while overcoming the challenges of mass production.

Experts warn that VinFast will need significant financial resources to sustain losses for several years as it seeks to establish itself in a crowded market. While Vuong is confident that his company can withstand the long-term marathon, sacrificing short-term gains for long-term success, it remains to be seen whether VinFast will succeed where others have failed.

Despite VinFast’s recent trouble, Vuong remains committed to his vision, lining up additional funding to expand the business. Vietnam’s richest man started his own business while studying in Moscow, which sold instant noodles and mashed potatoes, and eventually sold the company to Nestle for an undisclosed sum. Now he is betting billions of dollars on EVs, determined to make VinFast a success in a market where many others have faltered.

Despite the challenges that VinFast and other EV ventures face, the shift toward electric vehicles shows no signs of slowing down. Many countries have set ambitious targets for phasing out gas-powered vehicles, and automakers around the world are investing heavily in EV development.

However, success in the EV market is far from guaranteed, even for the wealthiest and most ambitious entrepreneurs. The industry is highly competitive, and established players like Tesla, as well as traditional automakers that have been in the game for over a century, have significant advantages in terms of technology, brand recognition, and distribution networks.

As VinFast and other EV startups try to gain a foothold in this crowded field, they will need to navigate a complex landscape of regulatory challenges, supply chain disruptions, and shifting consumer preferences. Only time will tell which companies will emerge as winners and which will fade away, but one thing is certain: the race for the future of transportation is on, and it’s going to be a bumpy ride.

In conclusion, Pham Nhat Vuong’s $8 billion wager on VinFast and its electric vehicles is proving to be a risky bet, with low sales figures and delays in listing in the US market. While Vuong’s ambition to compete with the likes of Tesla in the EV market is commendable, the challenges faced by other billionaires who have attempted to do the same should not be ignored. The competition in the EV market is fierce, and established players such as Tesla have already set the standard. Despite this, Vuong remains undeterred and has doubled down on his investment, committing another $2.5 billion to VinFast. Time will tell whether VinFast can achieve its ambitious goals and compete with the major players in the EV market.