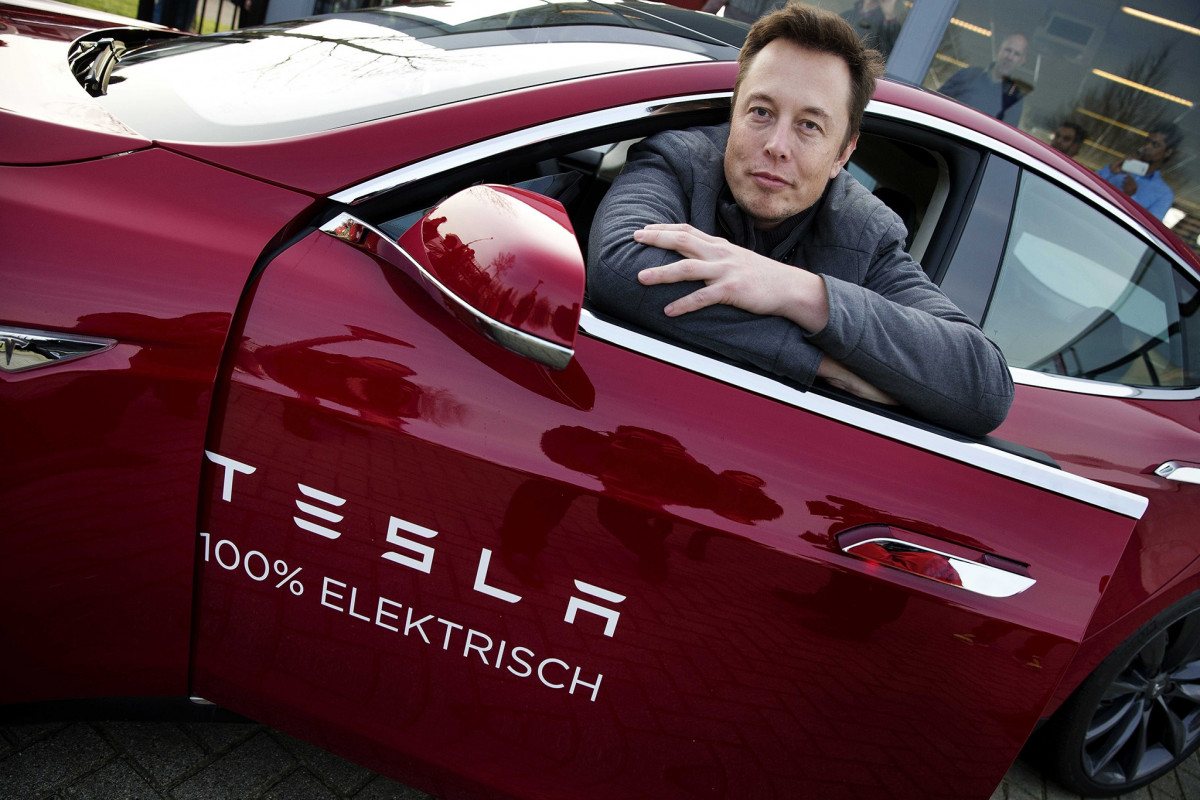

Elon Musk’s recent declaration that lithium batteries should be considered ‘the new oil’ has shone a spotlight on the burgeoning lithium battery market. This comes in light of Tesla’s announcement to invest $375 million in a lithium refinery in Corpus Christi, Texas, further highlighting the potential of this industry.

Several companies are set to benefit from this renewed interest in lithium batteries, with two lithium battery stocks priced below $10 garnering particular attention from Wall Street analysts.

Microvast Holdings, a leader in lithium-ion battery technology, offers a range of advanced battery solutions. Despite a dip in revenue in Q4 2022, the company reported a 35% increase in full-year revenue, reaching $204.5 million. While the stock has struggled over the past year, H.C. Wainwright analyst Amit Dayal believes the low price offers a compelling entry point for investors. Dayal cites a healthy balance sheet, a solid manufacturing and distribution presence, and a promising backlog as reasons for his bullish outlook on the stock.

Meanwhile, Li-Cycle Holdings, a specialist in lithium-ion battery resource recovery, has also attracted analyst interest. The company, which recycles lithium-ion batteries and recovers up to 95% of the materials used in the battery manufacturing process, recently received the Bloomberg New Energy Finance (BNEF) Pioneers Award for 2023. Piper Sandler analyst Alexander Potter emphasises the essential service the company provides, praising its strategic partnerships and a $375M loan from the Department of Energy.

The lithium battery market is still in its infancy, but with Tesla’s aggressive push into lithium refining and the growing interest from Wall Street analysts, it’s clear that the sector is set to play a critical role in the future of energy. As the world moves towards electrification, lithium could indeed become the ‘new oil’. It is essential for investors to conduct thorough research and analysis before entering this expanding field.

As the world continues to grapple with climate change, the shift towards renewable energy and electric vehicles is becoming increasingly imperative. Lithium batteries, which power everything from smartphones to electric vehicles, are at the heart of this transition. With tech giants like Tesla doubling down on lithium, the market potential is hard to ignore.

Microvast Holdings and Li-Cycle Holdings are two companies that are already making significant inroads in this industry. Microvast’s diverse range of advanced battery solutions and Li-Cycle’s innovative approach to resource recovery position them well to capitalize on the growing demand for lithium batteries.

However, investing in emerging industries is not without its risks. The lithium market, like any other, is subject to volatility and uncertainty. Furthermore, the ethical and environmental implications of lithium mining should not be overlooked. As this sector grows, it will be crucial for companies to invest in sustainable and responsible mining practices.

In conclusion, the lithium battery market is poised for significant growth in the coming years. As the world continues to embrace the digital and electric revolution, the demand for lithium, the ‘new oil’, is set to surge. For investors willing to navigate the potential risks, the rewards could be substantial. But as always, careful research and thoughtful analysis should underpin any investment decisions.

©traders-news.online