North Asia’s export powerhouses continued to stutter in April amid sluggish global trade and a patchy economic recovery in China, according to new data that amplified concerns about the risk of a global recession.

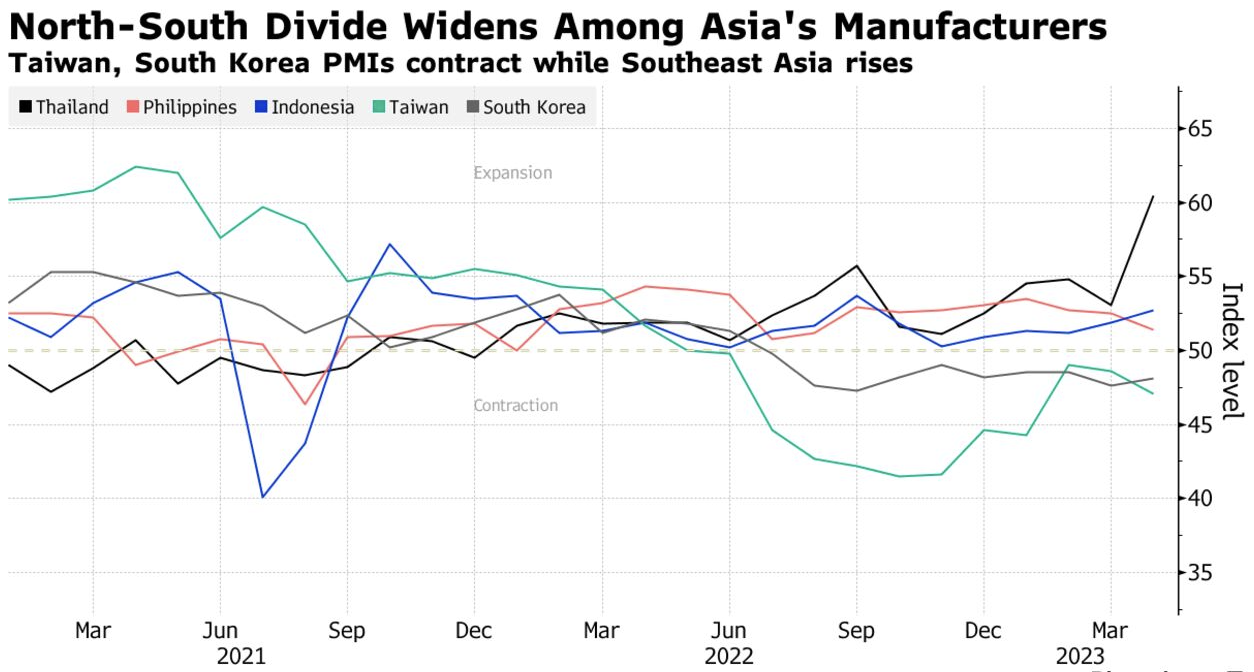

Factories in South Korea and Taiwan saw activity contract last month, according to surveys published Tuesday by S&P Global. Manufacturing purchasing managers’ indexes for those two economies registered readings of 48.1 and 47.1, respectively — each below the 50-mark that separates expansion from contraction.

The North Asia surveys contrasted heavily with those in Southeast Asia, where Thailand led the region with a record-high PMI reading of 60.4.

The Taiwan data showed firms “registering the quickest falls in output and sales for three months,” said Annabel Fiddes, economics associate director at S&P Global Market Intelligence, in commentary accompanying that release. “There were reports that weak demand conditions, particularly across key export markets such as the US, Europe and mainland China, continued to act as a drag on performance.”

World trade has been hamstrung by stubborn inflation and rising borrowing costs that have sapped demand across the US and Europe, hitting the growth of exports including critical commodities and consumer goods like electronics.

The regional PMI data came days after an official survey of manufacturing activity in China showed an unexpected contraction last month, calling into question the momentum of the recovery for the world’s second-largest economy. Much of Asia has been looking to China to create much-needed tailwinds, particularly for the services sector as the economy restarts travel, construction and investment.

The surveys once again showed a widening divide between the struggles in North Asia and the comparatively upbeat performances among factories further south.

Along with Thailand’s record PMI reading, neighboring Indonesia and the Philippines each remained above 50.

PMIs for India and Vietnam are set to be reported Wednesday. China’s Caixin PMI — a survey that focuses on smaller firms compared to the official PMI — is due Friday, and Japan’s Jibun Bank PMI data is scheduled for Monday.