Stocks Move Higher Amid Debt Ceiling Talks and Mixed Earnings Reports

In Friday’s pre-market trading, equity indices displayed an upward momentum as investors kept a close eye on progress in debt ceiling discussions and digested the largely upbeat results of the Q1 earnings season. The S&P 500 (^GSPC) edged up by 0.20%, while the Dow Jones Industrial Average (^DJI) posted a minor gain of 13 points or 0.04%, and the tech-dominated Nasdaq (^IXIC) rose 0.15%.

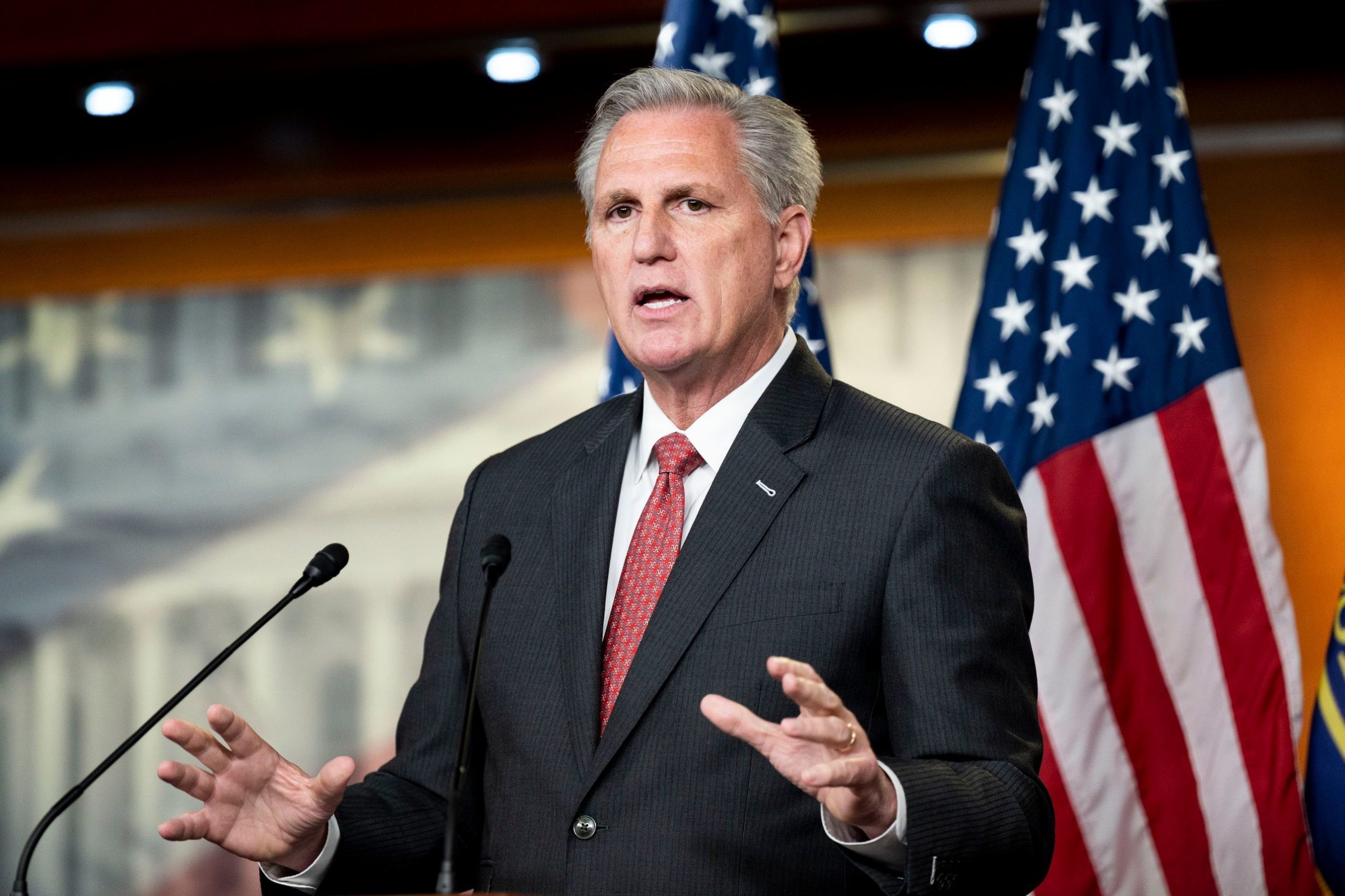

Optimism in the market was stoked by potential advancement in the debt ceiling negotiations in the nation’s capital. House Speaker Kevin McCarthy provided a beacon of hope on Thursday morning, telling reporters, “I see the path that we could come through.” He emphasized the necessity of striking a tentative agreement before the week’s end.

The upward trend on Friday morning builds upon a week of solid earnings reports, predominantly from tech behemoths. Notably, stocks of Netflix (NFLX), Apple (AAPL), Alphabet (GOOGL), Meta (META), Microsoft (MSFT), and Nvidia (NVDA) all ended Thursday’s trading at their highest levels in at least a year.

John Deere’s parent company, Deere & Company (DE), saw a 4% surge in its share price after elevating its profit outlook for the fiscal year. The farm machinery producer’s revenue and earnings outpaced Wall Street’s predictions. CEO John C. May, in the earnings announcement, pointed out that the firm continues to reap the benefits of “favorable market conditions and an improving operating environment”, notwithstanding the prevailing supply chain hurdles.

On the flip side, not all companies enjoyed a fruitful earnings report. Shares in Foot Locker (FL) took a nosedive, falling by 27% in the steepest decline since February 2022. The sports footwear retailer significantly slashed its full-year earnings per share forecast from the prior range of $3.35-$3.65 down to $2.00-$2.25, attributing this to a tough macroeconomic landscape. The company’s quarterly revenue and earnings per share also missed the street’s expectations, with same-store sales down 9% year-on-year.

Foot Locker’s CEO Mary Dillon commented on the less than stellar performance, “Our sales have since (March) softened meaningfully, leading us to reduce our guidance for the year as we take more aggressive markdowns to both stimulate demand and regulate inventory.”

Looking to the future, market players will be keenly observing remarks from Federal Reserve Chair Jerome Powell and ex-Fed Chair Ben Bernanke at a Washington, D.C. event, in search of any hints concerning the Fed’s next steps regarding interest rates.

In essence, despite the varying challenges, including debt ceiling talks and diverse corporate earnings, the stock market continues to demonstrate tenacity. Investors remain vigilant as ever, concentrating on possible changes in monetary policy and the evolution of the debt ceiling negotiations.

©traders-news.online