Soros Fund Management, the investment firm led by George Soros, has undertaken significant changes in its investment strategy by reducing its holdings in electric-vehicle manufacturers and major technology companies. The firm has made notable adjustments to its portfolio during the first quarter of this year, including the sale of a significant number of Rivian Automotive Inc. shares and the complete divestment of its position in Tesla Inc. These strategic moves align with Soros Fund Management’s efforts to adapt to market conditions and realign its investment focus.

In the first quarter, Soros Fund Management disposed of approximately 10.8 million shares of Rivian stock, resulting in a decline in the stake’s market value to $55.4 million, as revealed in a regulatory filing released recently. The remaining 3.6 million shares now represent a mere 1.1% of the firm’s $5 billion US equities portfolio. Rivian, a prominent electric-vehicle startup, had encountered a considerable setback, witnessing a steep decline of around 90% in its share price from its peak in November 2021 to the end of that year.

By providing a unique perspective and rephrasing the information, the segment highlights Soros Fund Management’s strategic adjustments in its investment portfolio, focusing on the reduction of holdings in electric-vehicle manufacturers and the impact of Rivian’s share price decline.

Complete Divestment from Tesla and Trimming of Tech-Related Positions:

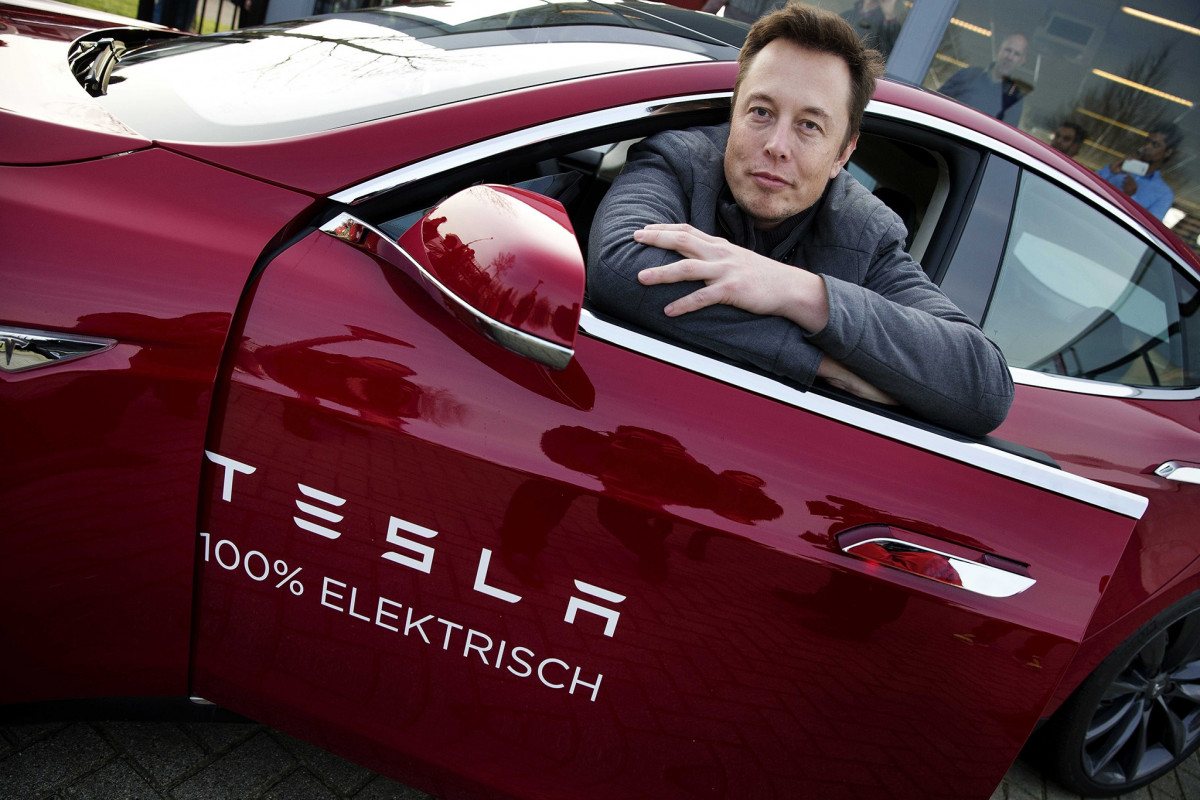

In addition to reducing its stake in Rivian, Soros Fund Management completely exited its $16 million investment in Tesla. This decision came after the firm had initially acquired a stake during a significant technology push in the second quarter of 2022. Furthermore, the investment firm trimmed its positions in other tech-related companies, including Alphabet Inc., Amazon.com Inc., Salesforce Inc., and Intuit Inc. These adjustments suggest a reassessment of Soros Fund Management’s exposure to the technology sector.

Soros Fund Management’s Performance and Philanthropic Focus:

During the first quarter, Soros Fund Management’s US equities portfolio experienced a decline of approximately $687 million. The firm manages assets primarily belonging to the Open Society Foundations, which focus on promoting democracy, human rights, and progressive politics. George Soros, with a net worth estimated at $8.5 billion according to the Bloomberg Billionaires Index, has dedicated a significant portion of his fortune to philanthropic endeavors through his foundations.

Insights into Investment Strategies of Money Managers:

The 13F form, which Soros Fund Management filed as per regulatory requirements, provides valuable insights into the investment decisions made by money managers overseeing over $100 million in US equities. It serves as a glimpse into the strategies of hedge funds and large family offices, shedding light on their positions in publicly traded stocks.

Conclusion:

Soros Fund Management’s recent changes to its investment holdings indicate a departure from electric-vehicle manufacturers and a reduction in exposure to technology giants. The sale of shares in Rivian following its substantial decline, as well as the complete divestment from Tesla, demonstrates a shift in investment strategy. As one of the leading investment firms managed by George Soros, Soros Fund Management’s decisions hold significance and provide insights into market trends and the evolving investment landscape.