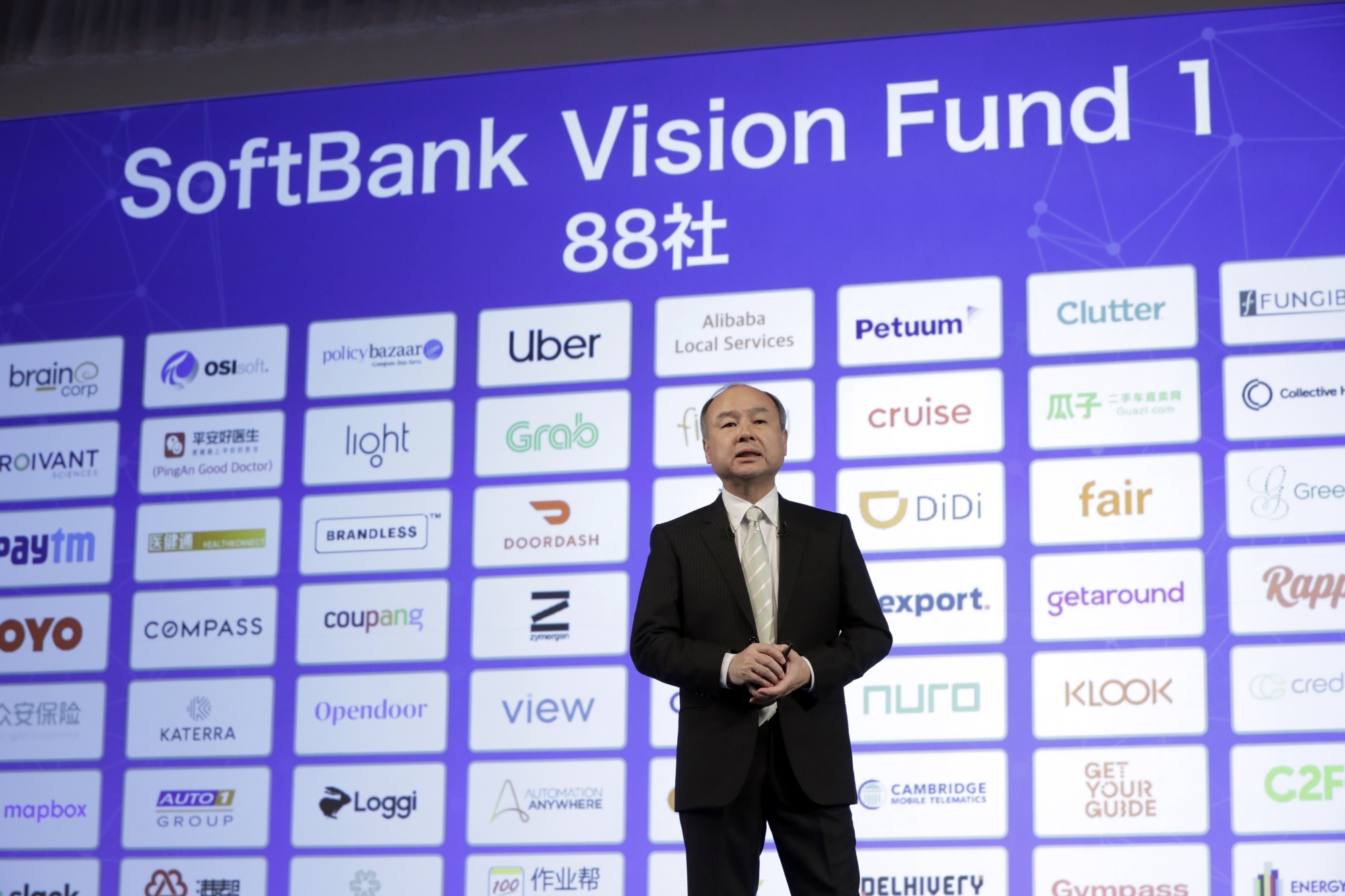

Masayoshi Son, the founder and CEO of SoftBank Group Corp., finds himself personally responsible for approximately $5.2 billion in side deals he established at the company, following substantial losses reported by SoftBank’s Vision Fund venture capital arm. The Vision Fund unit recorded a loss of ¥297.5 billion ($2 billion) in the three months ending in March, resulting in a total loss of ¥4.3 trillion for the fiscal year—its worst performance since Son proudly launched the business in 2017. Despite a global equity rebound, the world’s largest technology investor faced disappointing earnings due to losses incurred by unlisted startups in its portfolio.

During the recent quarter, SoftBank’s founder and CEO, Son, saw his unrealized losses rise by approximately $130 million, mainly due to the Latin America fund. By the close of December, Son had already suffered a loss of $5.1 billion from these side deals.

Apart from his stake in SoftBank, Son also possesses shares in the company’s primary investment vehicles. Despite the raised eyebrows concerning corporate governance, the Japanese tycoon has staunchly refuted any allegations of conflicts of interest.

Revelations from the March quarter show that portfolio losses have dug deeper into Son’s shortfall, registering approximately $2.9 billion for his Vision Fund 2 interest and $463 million for the Latin America fund. His remaining deficit at SB Northstar amounted to ¥246.9 billion ($1.8 billion). Estimations by Bloomberg, based on company disclosures, put the total debt at $5.2 billion.

Although there’s no imminent repayment deadline, Son’s positions’ value could potentially rebound in the future. For SB Northstar, Son has already injected some cash and other assets. The founder will bear his share of any “unfunded repayment obligations” at the end of the fund’s 12-year term, which includes a potential two-year extension.

After taking into account his deficit from his interests in SB Northstar, Vision Fund 2, and the Latin America fund, Son’s net worth was $8.9 billion after the market closed on Thursday, as per the Bloomberg Billionaires Index.

SoftBank shares experienced a decline in early Friday trading in Tokyo following the release of the financial results. The stock dropped as much as 5.5%, marking its most significant decline in approximately two months. In addition to the losses, investors were eagerly anticipating a buyback, which ultimately did not materialize.

The significant personal liability faced by Masayoshi Son, the founder and CEO of SoftBank Group, highlights the risks associated with his side deals and investments within the company. The record losses reported by SoftBank’s Vision Fund venture capital arm have put pressure on Son’s personal finances, with a total liability of approximately $5.2 billion. This situation raises concerns about the effectiveness of his investment decisions and the potential impact on SoftBank’s overall financial stability.

The losses incurred by the Vision Fund, particularly in unlisted startups, demonstrate the challenges and volatility of the venture capital landscape. Despite a global equity rebound, the fund faced substantial setbacks, leading to a significant decline in SoftBank’s stock price. This raises questions about the due diligence and risk management strategies employed by SoftBank and its leadership.

The ongoing controversy surrounding Son’s ownership in SoftBank’s investment vehicles further compounds the situation. Corporate governance concerns have been raised, and Son’s denial of any conflict of interest may not fully assuage investor worries. The financial results highlight the need for greater transparency and accountability in SoftBank’s investment practices to ensure the long-term stability and success of the company.

Looking ahead, Son’s net worth remains subject to fluctuations based on the performance of his investments and the potential for recovery in the value of his positions. The absence of an immediate repayment deadline provides some breathing room, but it also underscores the uncertainty surrounding the recovery of these investments. SoftBank’s future strategies, including potential buybacks or revised investment approaches, will be closely watched by investors to gauge the company’s ability to rebound from these losses and restore confidence in its financial prospects.

Overall, the personal liability faced by Masayoshi Son underscores the inherent risks and challenges associated with high-stakes investments and the need for robust risk management practices. The outcome of this situation will likely have significant implications not only for Son’s personal wealth but also for SoftBank’s reputation and future investment decisions. Investors will closely monitor how SoftBank addresses these challenges and adjusts its strategies to navigate the complex and volatile investment landscape.

©traders-news.online